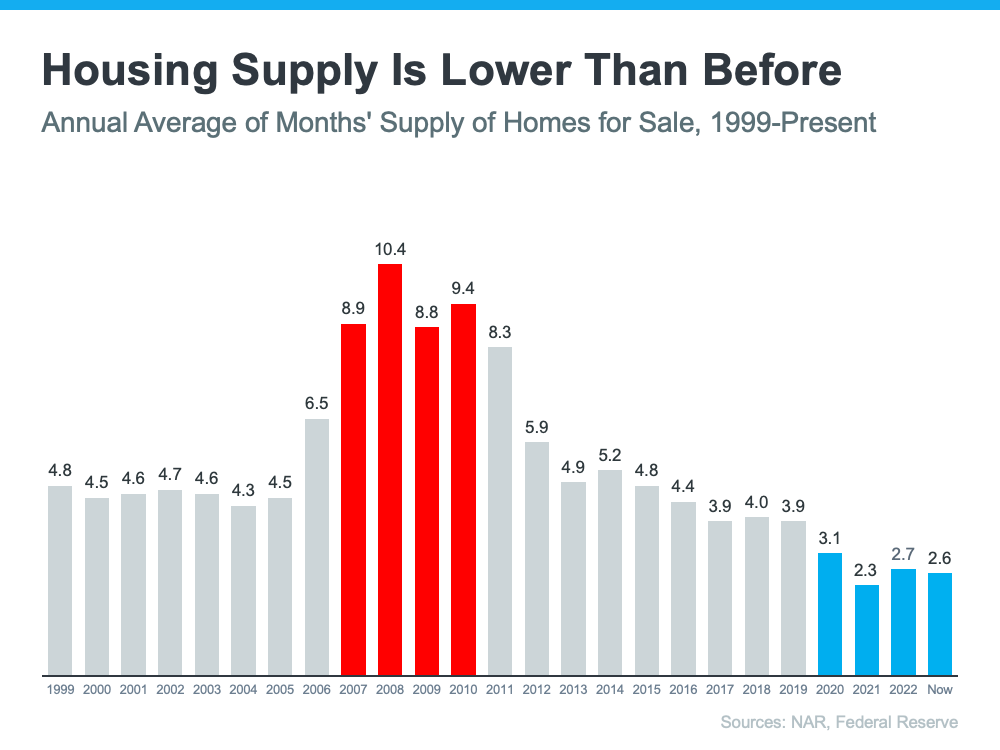

Why Is Housing Inventory So Low?

One question that’s top of mind if you’re thinking about making a move today is: Why is it so hard to find a house to buy? And while it may be tempting to wait it out until you have more options, that’s probably not the best strategy. Here’s why.

There aren’t enough homes available for sale, but that shortage isn’t just a today problem. It’s been a challenge for years. Let’s take a look at some of the long-term and short-term factors that have contributed to this limited supply.

Underbuilding Is a Long-Standing Problem

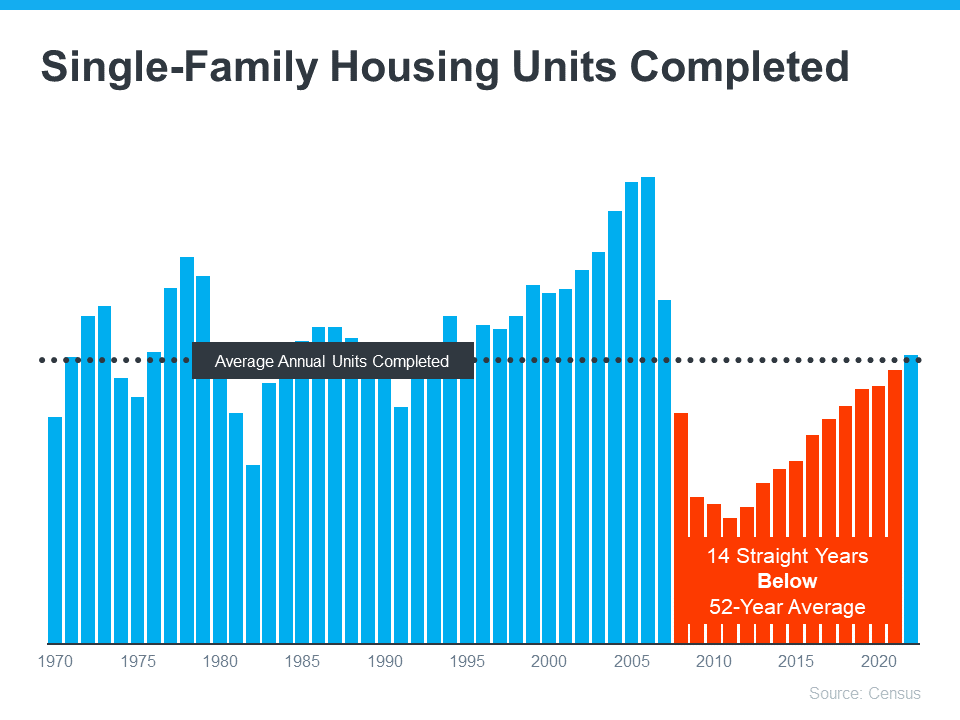

One of the big reasons inventory is low is because builders haven’t been building enough homes in recent years. The graph below shows new construction for single-family homes over the past five decades, including the long-term average for housing units completed:

For 14 straight years, builders didn’t construct enough homes to meet the historical average (shown in red). That underbuilding created a significant inventory deficit. And while new home construction is back on track and meeting the historical average right now, the long-term inventory problem isn’t going to be solved overnight.

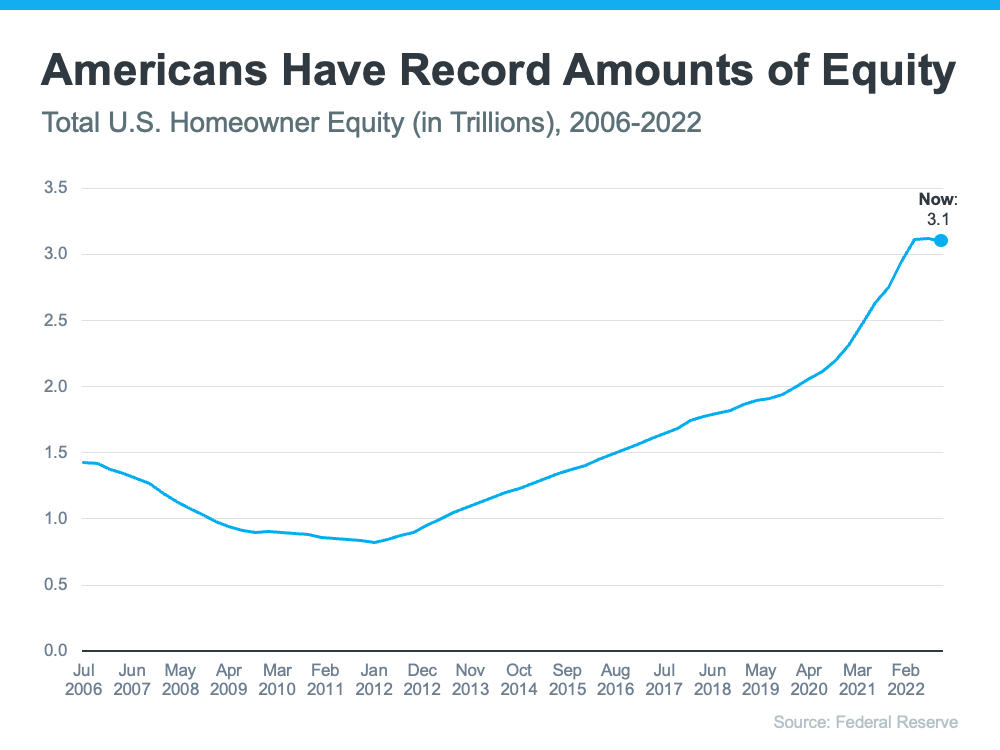

Today’s Mortgage Rates Create a Lock-In Effect

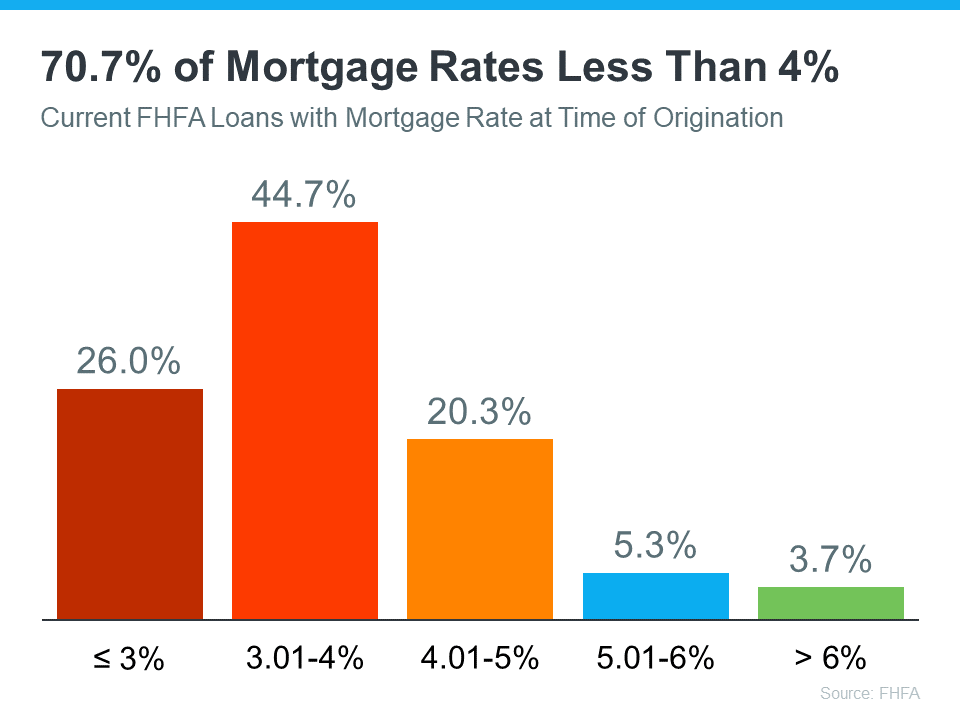

There are also a few factors at play in today’s market adding to the inventory challenge. The first is the mortgage rate lock-in effect. Basically, some homeowners are reluctant to sell because of where mortgage rates are right now. They don’t want to move and take on a rate that’s higher than the one they have on their current home. The chart below helps illustrate just how many homeowners may find themselves in this situation:

Those homeowners need to remember their needs may matter just as much as the financial aspects of their move.

Misinformation in the Media Is Creating Unnecessary Fear

Another thing that’s limiting inventory right now is the fear that’s been created by the media. You’ve likely seen the negative headlines calling for a housing crash, or the ones saying home prices would fall by 20%. While neither of those things happened, the stories may have dinged your confidence enough for you to think it’s better to hold off and wait for things to calm down. As Jason Lewris, Co-Founder and Chief Data Officer at Parcl, says:

“In the absence of trustworthy, up-to-date information, real estate decisions are increasingly being driven by fear, uncertainty, and doubt.”

That’s further limiting inventory because people who would make a move otherwise now feel hesitant to do so. But the market isn’t doom and gloom, even if the headlines are. An agent can help you separate fact from fiction.

How This Impacts You

If you’re wondering how today’s low inventory affects you, it depends on if you’re selling or buying a home, or both.

- For buyers: A limited number of homes for sale means you’ll want to seriously consider all of your options, including various areas and housing types. A skilled professional will help you explore all of what’s available and find the home that best fits your needs. They can even coach you through casting a broader net if you need to expand your search.

- For sellers: Today’s low inventory actually offers incredible benefits because your house will stand out. A real estate agent can walk you through why it’s especially worthwhile to sell with these conditions. And since many sellers are also buyers, that agent is also an essential resource to help you stay up to date on the latest homes available for sale in your area so you can find your next dream home.

Bottom Line

The low supply of homes for sale isn’t a new challenge. There are a number of long-term and short-term factors leading to the current inventory deficit. If you’re looking to make a move, let’s connect. That way you’ll have an expert on your side to explain how this impacts you and what’s happening with housing inventory in our area.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link