In Ogden Valley, STR rules shape value — and not knowing them can cost you.

Whether you’re in Eden, Huntsville, Liberty, or any corner of Ogden Valley, short-term rental (STR) rules are not only hyper-local — they’re often misunderstood. Some neighborhoods allow nightly rentals with ease, others require permits, while many are restricted to 30+ day stays. And when a buyer is purchasing as a second home or investment, those differences can make or break a deal — or change the price they’re willing to pay.

That’s why sellers can’t afford to guess. Julie Summers Christensen brings deep knowledge of local zoning and HOA restrictions — because she’s not just a real estate agent; she lives, works, and raises her family in the Valley. She knows which areas are STR-friendly, which require Weber County licensing, and which subdivisions simply don’t allow them at all. She also understands the nuance: a home with legal STR potential can often sell higher than a similar home without it.

Buyers looking for vacation properties near Snowbasin, Pineview Reservoir, or Powder Mountain will pay a premium for rental-approved zones, especially if the property already has views, access, furnishings, or proximity to recreation. On the flip side, if a home isn’t zoned for STRs, positioning it toward full-time residents, second-home families, or long-term rental investors becomes key — and Julie knows how to market both strategically.

The bottom line: Whether your home can be rented nightly absolutely affects value — but it’s not just yes or no. It’s about how well you understand the rules and how powerfully you use them in your pricing and marketing. With Julie on your side, you’re never guessing — you’re selling with clarity and confidence.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

But the best way to determine what’s best for you and your specific situation? Talk to a trusted local agent.

But the best way to determine what’s best for you and your specific situation? Talk to a trusted local agent.

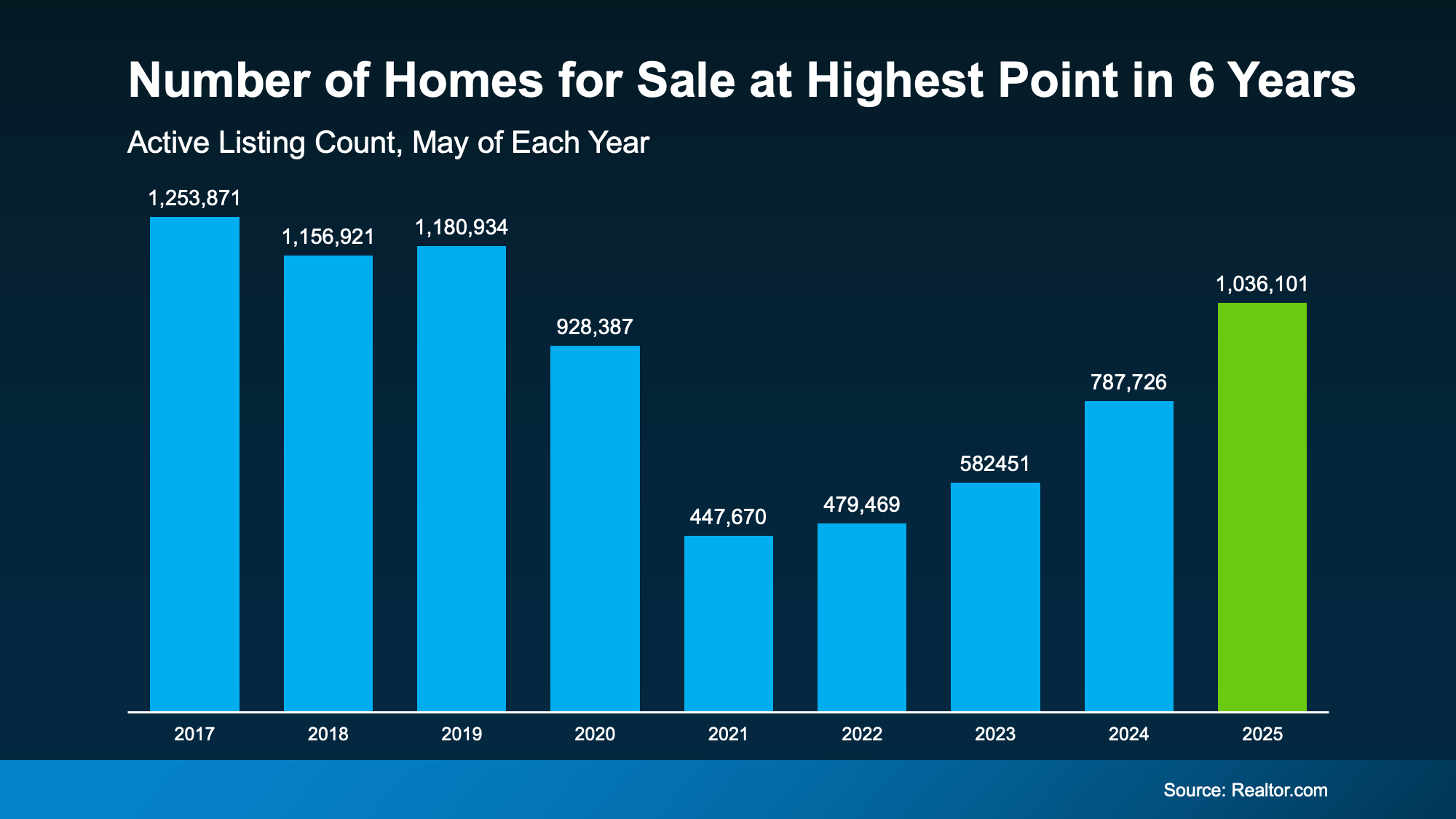

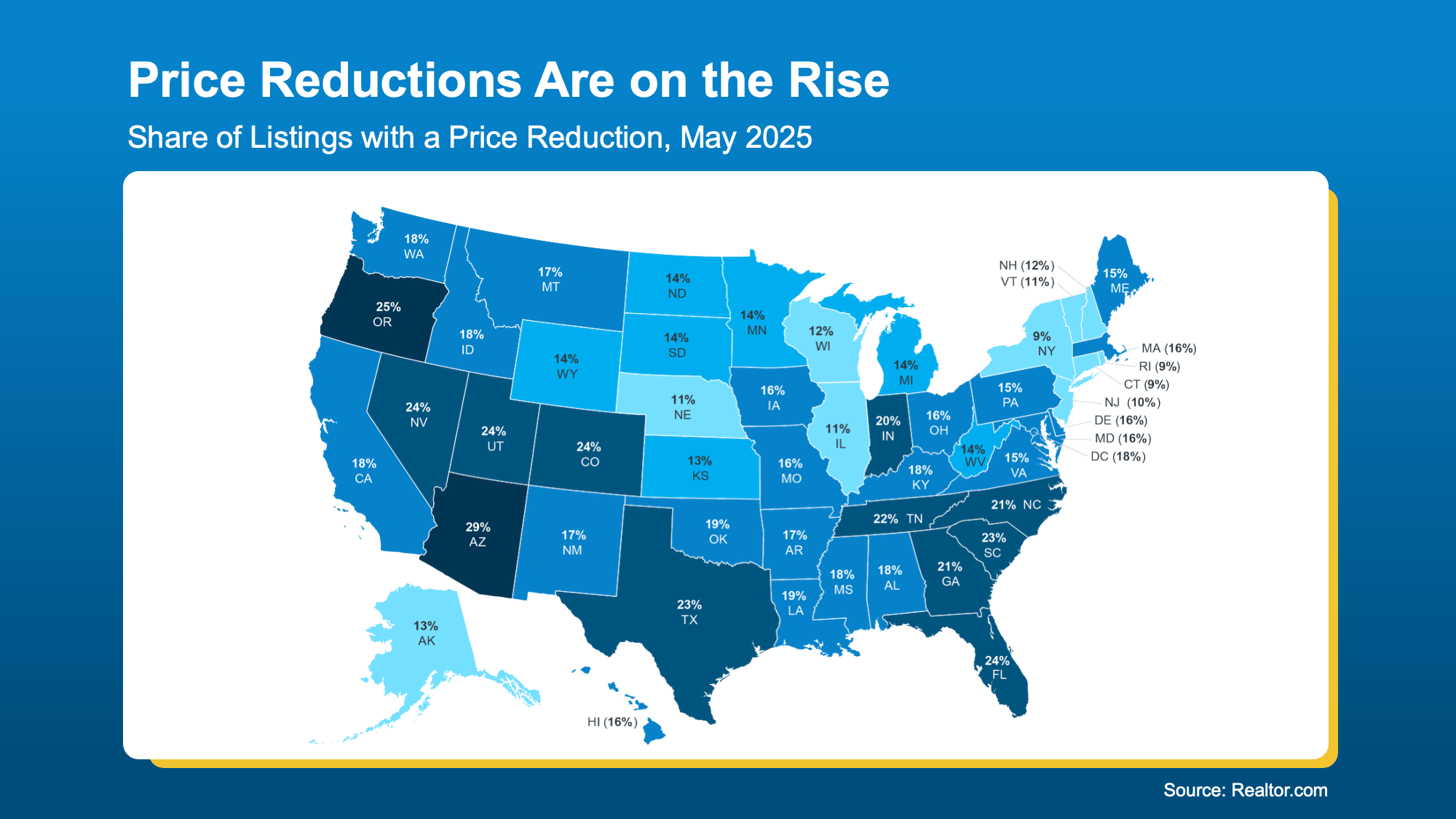

But inventory growth is going to

But inventory growth is going to

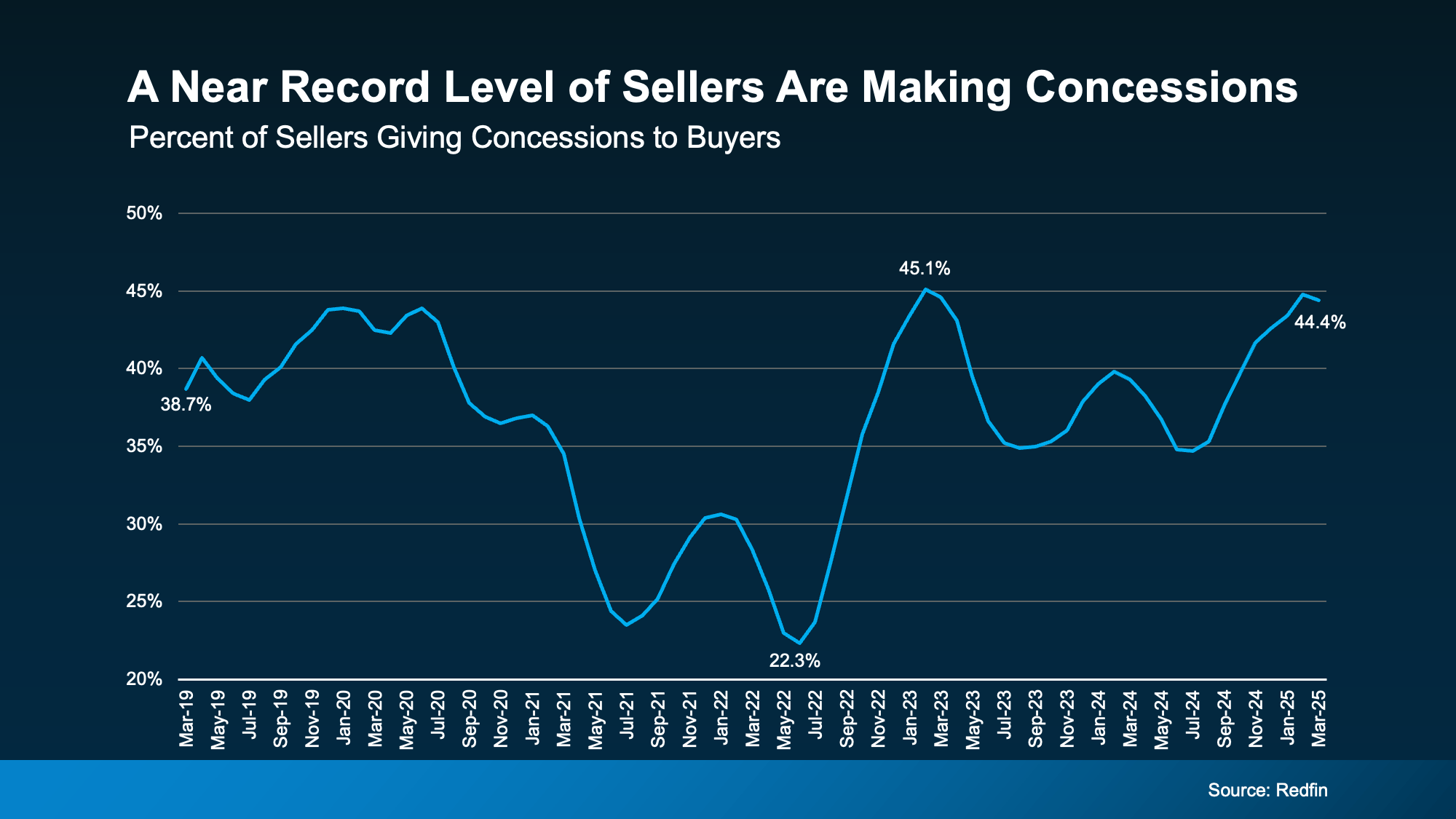

The takeaway? This isn’t a bad market. It’s just a different one. And it’s in line with more normal years in the housing market, like back in 2019. The savviest sellers are the ones taking advantage of every opportunity to work with buyers and make their house shine.

The takeaway? This isn’t a bad market. It’s just a different one. And it’s in line with more normal years in the housing market, like back in 2019. The savviest sellers are the ones taking advantage of every opportunity to work with buyers and make their house shine.

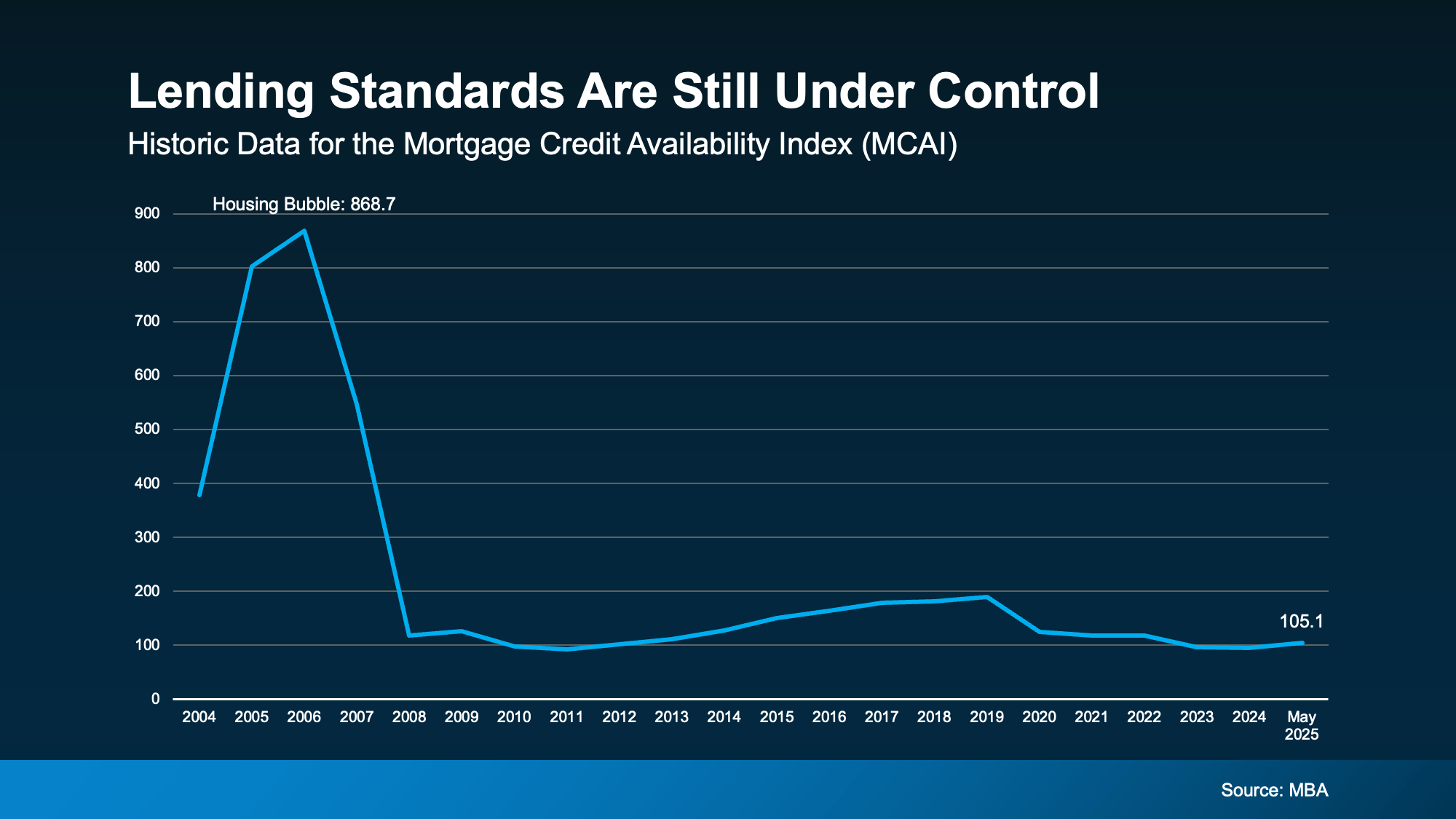

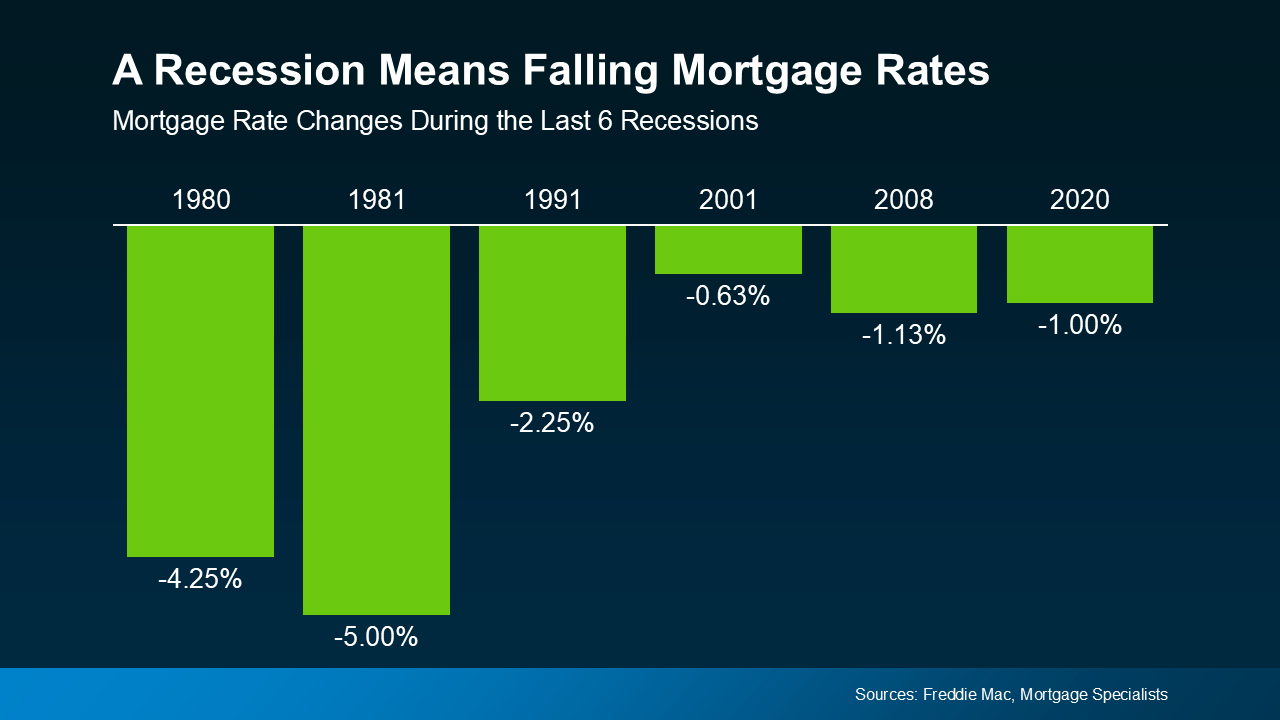

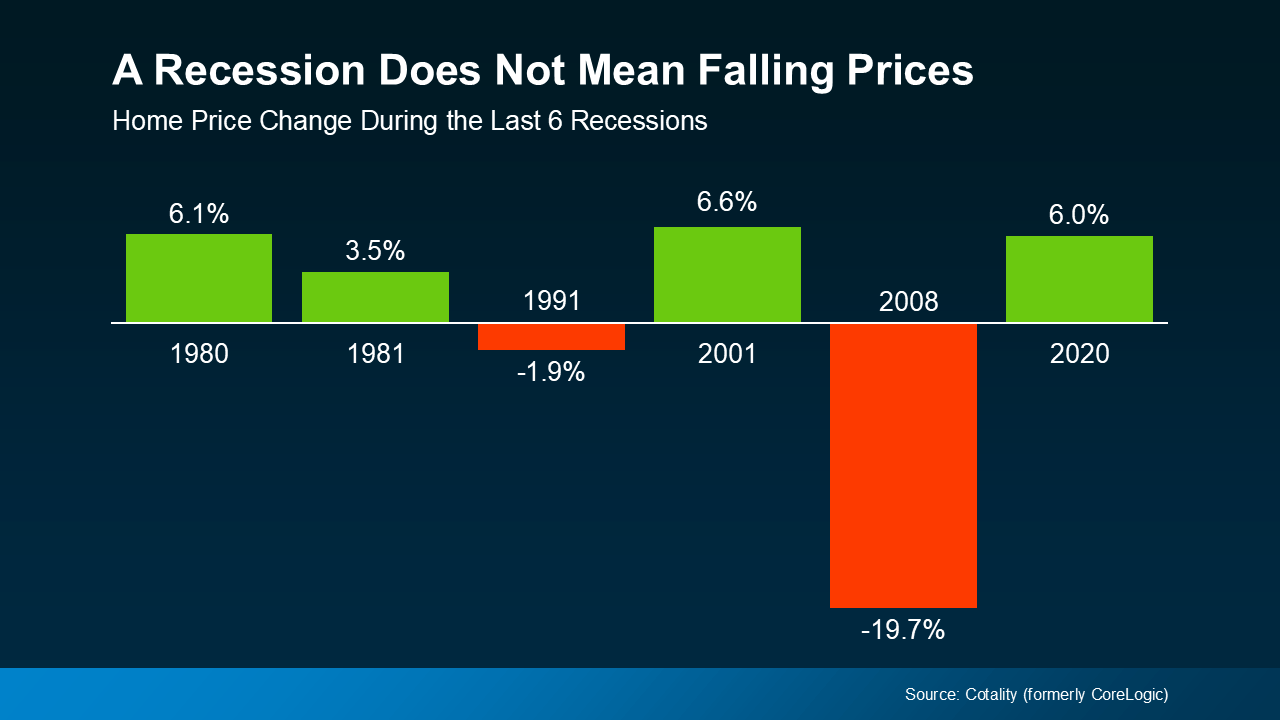

So, while many people think that if a recession hits, home prices will fall like they did in 2008, that was an exception, not the rule. It was the only time the market saw such a steep drop in prices. And it hasn’t happened since, mainly because there’s still a long-standing

So, while many people think that if a recession hits, home prices will fall like they did in 2008, that was an exception, not the rule. It was the only time the market saw such a steep drop in prices. And it hasn’t happened since, mainly because there’s still a long-standing